The 5 Attributes of Money, Part I: What Makes Money Money

As a modern society, we take for granted our current notion of money and how it works. But the concept of money is actually quite malleable and has gone through many notable shifts as we have innovated on financial and payments systems. For example, the proliferation of digital banking has created ease of access for some, but also completely restricted access to those who rely on cash or cannot open a bank account. The wave of digital asset innovation in the past 10 years has also shifted many different aspects of money and what it can do in new and important ways.

Ultimately, money is a very specific form of asset ledger that serves as a means of payment. The money ledger is foundational to a capitalist financial system as the unit of account that everything in the economy is denominated against and from which intertemporal decisions are made. It is also the means of payment for nearly every type of transaction within the economy. Small shifts in how money works can therefore have large implications. Gold, fiat money and cryptocurrencies (e.g. Bitcoin) are examples of ledger systems with different embedded features and technological capabilities. These features distinguish how we use those systems and what possibilities they enable.

It is worthwhile dissecting the empirical attributes of money so we can understand what makes various forms so fundamentally different from each other — and so we can try to move toward a more optimal construct given the many new possibilities technology is now enabling.

Below are the five most important attributes for money ledgers and the most common expressions of these traits.

1) Anonymity — The degree to which a third party or central administrator can track identity and transaction details on the ledger

- Anonymous: no direct link between a person’s identity and a transaction (e.g. gold, some crypto currencies like Monero, Zcash, physical fiat cash)

- Pseudonymous: transactions are not linked to a person or identity; however, all transactions are publicly accessible (e.g. Bitcoin, Ethereum)

- Traceable: direct link between a person’s identity and a transaction (e.g. Central bank settlement or reserve accounts)

2) Centralization — The concentration of control over the ledger

- Centralized: a single entity controls the ledger (e.g. Central bank, Treasury, Libra)

- Decentralized: multiple participants have the ability to edit the ledger (e.g. gold, Bitcoin)

3) Openness — How much access there is to the ledger

- Open: peer-to-peer so anyone can access the ledger (e.g. Bitcoin, gold, physical fiat cash)

- Closed: restricted to members (e.g. central bank money via commercial banks, Libra)

4) Limit of Supply — How readily can the quantity of the ledger change

- Constrained, either programmatically or by nature (e.g. Bitcoin, gold)

- Unconstrained: more can always be created (e.g. all central bank money including physical and digital)

5) Physicality — Whether the ledger system is natively in a material or dematerialized form

- Digital: meaning the ledger or subledger is fully dematerialized (e.g. commercial bank money, Bitcoin, Libra)

- Physical: existence in tangible form (e.g. gold, physical cash)

Image 1: The Five Attributes of Money — Visualized

With this taxonomy in mind, it is possible to better understand some of the most common money ledgers and how they compare to each other.

Applied to physical dollars, this theory describes physical dollars as inherently private, centralized, open, unconstrained and physical. Digital banking and electronic payments added the convenience of digital ledgers, but simultaneously decreased privacy and constrained access. The stablecoins we designed at Paxos maintain the privacy and open access of physical dollars, while decentralizing the ledger to allow greater access to it and reduce dependencies on central intermediaries.

This next version of the “money flower” shows examples of money that has taken on different attributes, including current and past systems that have been created.

Image 2: The Five Attributes of Money — Examples

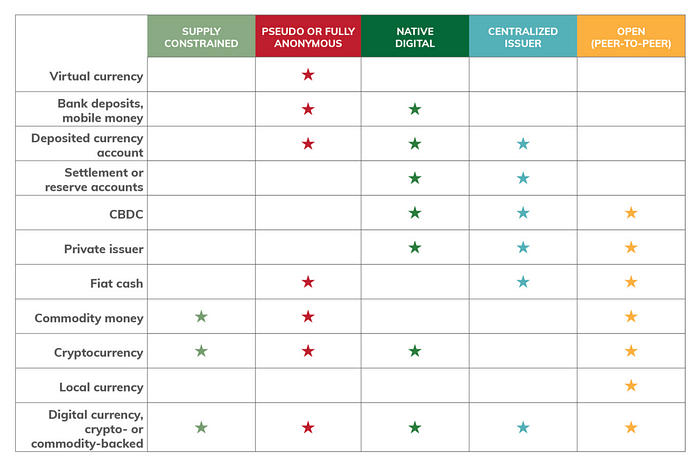

Finally, here is a chart that compares the various attributes and examples.

This construct helps us to dissect how various forms of money ledgers differ and the transformation of money over time. Importantly, this foundation also allows us to examine some important implications and hypothesize on the future — stay tuned for the next piece in this series.